In today’s post, I will show you exactly how to get lenders to forgive loans in 2020.

In fact, this process is currently helping most small business owners get out of their business loan debts.

And today I’m going to show you exactly how they are doing it!

So, let’s dive right in.

What are the Available Loan Programs Known to Forgive Loans for Businesses?

Due to the outbreak of the Covid-19 virus, loan programs were established to help forgive business owners of their loan debt(s).

In fact:

As of mid-April 2020, 755,476 forgivable economic injury disaster loan advances and 1,661,367 forgivable paycheck protection program loans had been approved by the SBA (Small Business Administration).

And for small business owners who are fortunate enough to receive one of these types of loans or loan advances before the June 30, 2020 deadline (for Paycheck Protection Program loans), and December 16, 2020, (for Economic Injury Disaster Loans), the next major struggle would be to get the loan forgiven.

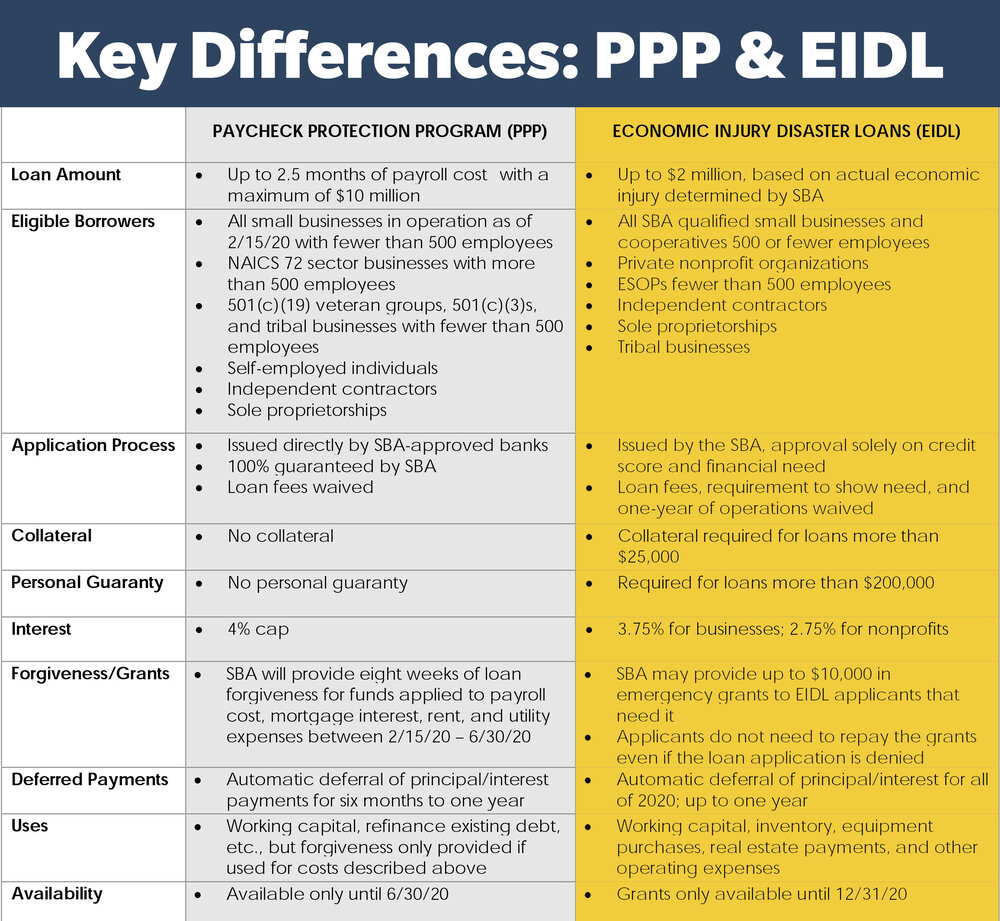

The two government loan programs that forgive loans during this Covid-19 crisis are:

- The SBA EIDL program

- The SBA PPP loan program

#1: The SBA Economic Injury Disaster Loan (EIDL) Program

The already existing SBA EIDL (Economic Injury Disaster Loan) program features an up-to-$10,000 loan advance that doesn’t have to be repaid, making it effectively a grant.

By now, you’re probably familiar with the CARES Act by the SBA which offers financial relief to small businesses through two targeted loan packages – the PPP and the EIDL.

The EIDL program is meant for only small businesses that are located in major disaster areas.

And by small business, they mean any business with less than 500 employees, is organized mainly to generate profit, has a business branch in the United States – contributing to its economy via tax payment or the use of American based products, materials, or labor.

Such business must also be independently owned, operated, and is not dominant in its industry on a national basis.

This program also applies to independent contractors, sole proprietors, and self-employed individuals.

The Covid-19 EIDL program was designed to provide economic relief to small businesses that are currently experiencing a loss of revenue due to the pandemic.

You can get started with your application on the SBA Disaster Assistance web page. This application is made available from now till Dec. 16, 2020.

#2: The SBA Paycheck Protection Program (PPP)

The Paycheck Protection Program is a loan program designed to assist small business

SBA will forgive loans if you as a business owner can keep the payroll of your employees consistent for eight (8) weeks.

The Small Business Administration (SBA) allows small business owners to apply for a PPP loan in addition to an EIDL, so long as they don’t use the funds from each loan for the same purpose.

The SBA PPP loan program offers forgivable loans of up to $10 million. Most advances and loans so far that have been given out to some small business owners have been much smaller than the maximum.

You can get started with your application on the SBA Paycheck Protection Program Assistance web page.

Note: When small business owners choose to have lenders forgive loans they have taken, they should be very careful while doing it.

Small Businesses Looking to Forgive Loans Could be Stuck with Debt

According to the New York Times, business owners who choose to convert their Paycheck Protection Program loans to grants may not be successful with it.

As more and more small business owners choose to sign up for their 8-week loans to be forgiven, banks and lenders are now starting to realize how complicated their instigated program may turn out to be.

The United States Treasury Department Secretary (Steven Mnuchin) along with its lawmakers keeps tightening the terms of the lending program to keep large companies off from taking money, while still making the loan forgiveness requirements easier to meet for small businesses and startups.

Mr. Mnuchin said:

The United States Treasury would review any company that takes up more than $2 million in loans and would hold firms criminally liable if they did not meet the terms of the program.

Senator Marco Rubio of Florida said that the PPP program’s biggest challenge to forgive loans was due to too little funding.

There has been a greater demand to forgive loans than the supply of funds needed to forgive the loans and this could lead the United States Treasury Department to use its regulatory authority to give borrowers better flexibility in how they use up their loans.

Senator Ben Cardin, a Maryland Democrat and a lead negotiator behind the program formation said:

We recognize that when we crafted the program, eight weeks, we thought, would be enough — we now know that our economy is not going to be up and running within that eight-week period in most of the country

In the past couple of days, more than 20 bipartisan senators have urged Mr. Mnuchin and Ms. Carranza to change the loan forgiveness criteria to allow small businesses, and particularly restaurants, to use the program, saying just 50 percent of the loan should be devoted to employee’s payroll, with the rest to pay for other overhead.

Small business owners are hereby advised not to take up more than they can chew as these loan forgiven terms are still under deliberation.