This is an introductory guide to invoice factoring for small business owners in 2020.

In this in-depth guide you’ll learn:

- Invoice factoring for small business owners;

- How does invoice factoring work;

- Various invoice factoring requirements;

- Invoice factoring pros and cons;

- And lots more.

So if you’re ready to go “all in” with invoice factoring in 2020, this guide is for you.

Let’s dive right in.

Invoice Factoring Fundamentals

Every small business owner or startup has had an issue at some point in collecting payments from clients and customers… And this could lead to poor business cash flow management!

Invoice factoring is actually one of the best ways for small business owners to get an advance on their outstanding invoices for a specific sale or service rendered. This famous accounting practice has its origin traced back to the world’s earliest civilizations from North Africa and the Middle East.

In Ancient Rome (31 BC – 476 AD), a factor had a similar role in the business world as the factors of today!

Roman factors helped businessmen conduct financial transactions, from buying and selling to taking goods on consignment.

Factoring became more prominent during the British Empire (1550 – 1800) where the East India Company and the Hudson Bay Trading Company both used it to establish their dominant commercial empire during the Age of Discovery.

Ever since then, factoring has become a very popular method of finance for businesses worldwide. Once the Massachusetts Bay Colony started operating with a team of factors, that made other colonial trading companies realize the benefits of factoring.

The word FACTOR originates from Latin which means “he who gets things done” !

Invoice factoring for small businesses is a strategy that most business owners adopt for their cash flow management… And the concept is quite easy to understand.

This system of accounting is best for businesses that have slow-paying customers!

The factor now takes up the responsibility of collecting on the debt from the customer when due… And that is basically how the invoice factoring works.

How Does Invoice Factoring for Small Business Work?

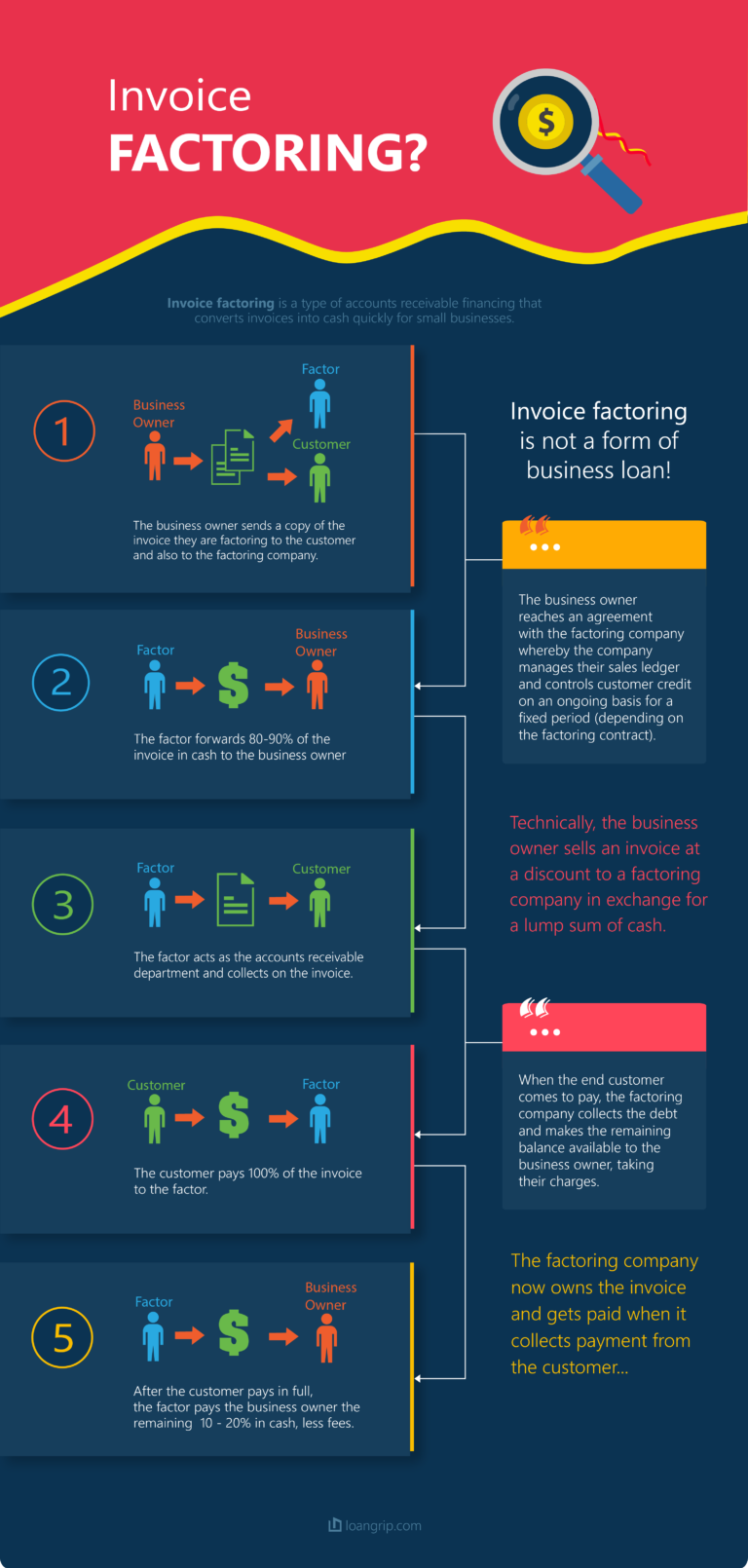

In invoice factoring, the business owner reaches an agreement with a factoring company whereby the company manages its sales ledger and controls its customer credit.

Here’s a brief break down of the infographics shown above…

#1: Business Owner >> Factor & Customer

The business owner first provides goods or services to only a creditworthy customer. A copy of the invoice for the customer’s purchase is given to the customer, and a different copy of the invoice is giving to the factor.

#2: Factor >> $ >> Business Owner

The unpaid invoice given to the factor is paid for by the factor at a rate agreed with the business owner. That is to say, the factoring company (factor) buys over the business owner’s debt!

But note that, the factor doesn’t pay in full for the unpaid invoice. The money paid by the factor is just an advance of what the customer owes the business owner.

#3: Factor >> Customer

The factor acts as the accounts receivable department and collects on the unpaid invoice!

Since the factor has bought over most of the business owner’s debt, he’s in charge of ensuring that the customer pays off the unpaid invoice.

#4: Customer >> $ >> Factor

Instead of the business owner, the factor is the one that collects payment from the customer.

Note that the factor collects 100% of whatever funds the customer owes the business owner. Once that is done, they proceed to #5.

#5: Factor >> $ >> Business Owner

The factor now pays the business owner the remaining balance on his invoice minus a fee for his service as a factor. So in the end, nobody loses!

The customer gets given favorable payment terms… The factor negotiates more on the payment terms with the customer and makes sure the business owner gets a return for his product sold or service rendered.

For example:

Let’s say you own a shoe retail store and sell goods to a customer, creating an invoice of $9,000. Your customer agrees to pay off on the invoice in 30 days… But the problem is, you really need the cash the next week to pay off employees!

Turning to a traditional bank for funding would require a stellar personal credit plus collateral, and many more… And even though you qualify for the business loan, you may have to wait for several months for the loan to close.

So the best choice for you is a factoring company!

The factoring company agrees to buy your invoice for $8,370 in cash – $9,000 minus a 7% factoring fee ($630). But the factoring company won’t pay you in full immediately, instead, they pay you an 85% advance of the invoice ($7,114.5) within a few days.

And once the customer is due to pay off his debt, the factoring company collects the invoice and refunds you your remaining balance ($1,255.5).

Factoring companies work best with B2B businesses that have notable clients and longer net terms... Share on XExamples of these type of businesses include:

- Transportation,

- Manufacturing,

- Construction,

- Distribution,

- Staffing services,

- Freelancers (PR & creative, marketing, etc),

- IT services and software development,

- Retail businesses,

- Oil and Gas service companies,

- Commercial services,

- Consulting

Basic Types of Invoice Factoring for Small Business Owners

There are basically two types of invoice factoring:

- Recourse factoring,

- Non-recourse factoring…

Recourse Factoring

This type of invoice factoring places no form of risk on the factor.

Here, the business owner sells his invoices as usual to a factor… But this time, he’s the one that buys back any uncollected invoices if the customer fails to pay back his debt.

90% of invoice factoring is recourse! This is to avoid the high risk of unpaid accounts. Share on XThis is the most affordable type of invoice factoring, but could be a bad choice for business owners that have inconsistent paying buyers!

Non-Recourse Factoring

This is quite different from the recourse factoring in the sense that:

The factor absorbs all the risks of the business owner, and due to this high level of risk imposed on the factor, this type of factoring is considered the most expensive – with high transaction fees!

Here, the factor is charged with the task of writing off the debt for the business owner if the customer refuses to pay. This may differ though…

The business owner could also be charged to re-purchase the unpaid invoices if he failed to fulfill the customer’s order completely.

Now, comparing these two types of invoice factoring, one may find it difficult in choosing the best that fits his or her business.

But this should help…

1) Choose recourse factoring only when:

- You really trust your customers not to default.

- You’d be able to bear the cost just in case a client defaults.

- You aren’t able to afford the upfront fees from a factor.

2) Choose non-recourse factoring only when:

- You trust your product delivery to avoid complaints from customers.

- You don’t trust your customers to pay back debts.

- You won’t be able to bear the costs if a customer defaults.

- You can afford the upfront fees from a factor.

Invoice Factoring Based on Business Type and Agreement

Apart from these two types of invoice factoring, there are also other types of factoring. These vary based on business type and agreement between a business owner and the factor. They include:

- Domestic & cross-border factoring,

- Disclosed & undisclosed factoring,

- Supplier guarantee factoring,

- Bank participation factoring,

- Whole turnover factoring,

- Selective factoring

- Spot factoring

- Freight bill factoring

#1: Domestic & Cross-Border Factoring

In domestic factoring, all three parties that are involved in the business (the business owner, factor, and customer) all reside in the same country. This type of factoring service is less expensive than the cross-border factoring and requires only a single factor.

While cross-border factoring involves the delivery and implementation of factoring solutions for businesses across the borders (internationally). It can also be regarded as export factoring!

This type of factoring, unlike the domestic factoring, involves four parties (the business owner, import factor, export factor, and finally the customer)… And since there are two factors involved in the deal, cross-border factoring is also called the two-factor system of factoring.

This two-factor system of factoring results in two separate but inter-linked agreements:

- A link between the cross-border client and the export factor,

- …and a link between the import and export factors.

The import and export factors usually belong to a formal chain of factors with well-defined rules that govern the conduct of their business.

The import factor serves as the link between the importer and the export factor. Import factors help to solve international barrier issues such as like language problems, legal formalities, and many more. They also underwrite customers’ trade credit risk, collect receivable and help to transfer funds to the export factor in the currency of the invoice.

The flow of documents between the business owner (exporter), the import and export factors, and the customer (importer) in cross-border factoring takes the following steps:

Step #1: Business Owner (Exporter) >> Export Factor

Step #2: Export Factor >> Import Factor (1)

The export factor notifies the import factor who is based in the country of the importer (customer), enquiring about the reputation and how credit-worthy the importer is.

Step #3: Business Owner (Exporter) >> Customer (Importer) >> Export Factor

Step #4: Export Factor >> Import Factor (2)

Step #5: Import Factor >> Export Factor

The import factor collects payment from the customer and transfers it to the export factor as per the terms of the assignment in the currency of the invoice.

Step #6: Export Factor >> Business Owner (Exporter)

The export factor now makes the final payment to the business owner on collection from the import depending on the type of factoring arrangement between them.

The cross-border type of invoice factoring operates on the basis of non-recourse factoring. That is, the factor becomes the sole debtor to the business owner once every documentation is complete and goods are successfully shipped to the customer.

This can be a more appealing approach to small business owners that offer international deliveries and services. They do not hold the risk of losing everything supposing the customer defaults!

#2: Disclosed & Undisclosed Factoring

The concept of disclosed and undisclosed factoring is quite easy to understand!

A disclosed type of factoring means that the customer is aware of the factoring arrangement of the business. The factor’s name is clearly indicated on the invoice of the supplied goods or services.

While an undisclosed type of factoring means that the customer has no clue about the factoring arrangement of the business. The business owner could picture the factor as a staff of his business to the customer and request that all payments should be made to him.

#3: Supplier Guarantee Factoring

This is a bit different from the normal factoring you know about! Here, instead of the factor to serve as a link between the business owner and his client, the factor links the business owner and his suppliers.

Let’s review a hypothetical scenario…

A manufacturing company needs to make a very large purchase of inventories from another company… But the manufacturing company does not have enough credit with its suppliers to purchase such inventories.

A very good alternative is the supplier guarantee factoring which combines factoring with a vendor guarantee!

Supplier guarantee factoring is where the role of the factor is to guarantee the payment of a business supplier. It is a very innovative way which small business owners can use to get out of difficult financial situations…

Supplier guarantee factoring is not a form of business loan... It is just a different type of invoice factoring for small business owners! Share on XEssentially, the supplier relies on the credit and guarantee of the factor for the payment of the goods bought by the business owner.

The factor guarantees the payment of the suppliers of the business via the vendor guarantee!

A vendor guarantee is an agreement between a business owner, his business supplier and a factoring company. In the agreement, the factoring company agrees to pay the business supplier directly out of the proceeds of the factored invoices.

This simply means that the factor agrees to provide advances and rebates to the business supplier until the business owner’s obligations are fulfilled… Once this is done, any additional funds will be remitted back to the business owner. Now the business owner can get the needed credit and supplies for his business.

Vendor guarantee is also helpful in other ways:

For small businesses and startups… Often times, large companies or government entities will want to make sure you have the creditworthiness and working capital to fulfill your contracts and commitments. A factoring company can write letters on your behalf showing your clients that you have a specific dollar amount of credit facility in place; and if worst comes to worst, issue out a vendor guarantee on your behalf.

#4: Bank Participation Factoring

Bank participation factoring involves a bank participating in the factoring process by providing an advance to the client against the reserves being maintained by the factor.

Here’s exactly what I mean:

Assuming a factor has advanced 80% of the value of the factored receivables and the bank provides an advance limited to 50% of the factor reserves. The client is now required to fund only 10% of the receivables and the 90% balance is provided by the factor and the bank.

That is, the margin of a factor is also financed by the bank!

This type of invoice factoring is best for businesses for whom even the smallest margin of money is important… And allows business owners to have complete finance of their account receivables.

#5: Whole Turnover Factoring

This is the best solution for small businesses that are expanding and would like a long-term option for their invoice factoring. This type of factoring requires a business owner to sign up for at least 12 months pf factoring on all invoices received during that period.

This is the cheapest type of invoice factoring for small business owners!

With the whole turnover factoring, you can expect:

- Lower rates and fees.

- Contract locked for at least a year.

- Less flexibility (invoices are typically factored in the order they’re received).

- Additional credit and debt collection services may be required.

#6: Selective Factoring

This type of factoring lets business owners decide which invoices they want to factor or not. This allows companies to easily account for a number of factors that can affect their income… Such as peaks in trades, the time it takes for customers to pay on invoices and unique agreements with specific customers.

Just like the whole turnover factoring, selective factoring also usually involves a contract of at least a year.

Selective factoring is best for small businesses that deal with a diverse array of customers and clients! Share on XWith selective factoring, you can expect:

- Better relationship with customers and clients

- Higher rates and fees

#7: Spot Factoring

This type of factoring in a way sounds like the synonym of selective factoring.

Spot or single factoring is a type of invoice factoring where the small business owner chooses to factor just a single invoice.

It is usually handled as a single transaction with no expectation of future business, but some business owners see it as an alternative from time to time if the need arises.

Spot factoring offers a lot of flexibility to its users, but it can be really expensive compared to the conventional factoring.

With spot factoring, you can expect:

- Flexibility.

- Short term commitments.

- More expensive than other types of invoice factoring.

#8: Freight Bill Factoring

Freight bill factoring is a type of invoice factoring that allows trucking companies to quickly receive cash for unpaid freight bills.

It’s one way in which small business owners can handle cash flow problems as a result of slow-paying clients. These funds can be used to pay workers, purchase gas for trips, and more importantly, take on more loads for the freighting company.

While there are so many opportunities for freighting companies, profit margins can be really slim for the small and mid-sized. This is usually due to heavy competition, resulting in the lowest bidder to often securing the job.

Generally, any transport company that hasn’t pledged its accounts receivable as collateral is eligible for freight factoring services.

Invoice Factoring Requirements

Factoring companies work with certain terms and rates that are determined by a number of factors, some of which include, but not limited to the following:

- Business type

- Net terms of the invoice

- Type of service

- Volume of invoices

- Quality of clients

First things first, invoice factoring companies require that you are already operating a business… And basically, your business sells either products or services to individuals or other businesses.

Factoring plans can provide many of the financing benefits associated with a line of credit. However, they are much easier to qualify for than conventional financing.

Invoice factoring can also be regarded as Accounts Receivable Financing or Invoice Discounting... Share on XMost factoring companies have fairly simple requirements to qualify. The following is a list of the main requirements to qualify for invoice factoring.

1) You must operate a business

Factoring can provide financing to businesses only. Some factoring companies can operate with sole proprietorships and partnerships. However, most factors prefer that your business be formalized through a corporate structure such as a Corporation (Inc.), Limited Liability Company (LLC), or a similar alternative.

2) Your business must have commercial or government clients

Factoring plans provide financing by allowing you sell your accounts receivable to a factoring company. Factors favor businesses the most whose clients are commercial companies or government entities. Unfortunately, factoring companies cannot buy invoices due from retail customers.

3) Your client’s commercial credit must be good

The most important benefit of factoring is that it provides funding based on the credit quality of your invoices, rather than the credit of your company. Factors will only finance high-quality invoices that are very likely to be paid on their due date. Factoring companies determine the credit quality of your invoices by checking the commercial credit of your clients.

4) Your profit margins must be above 10% to 15% (varies)

Due to its cost, factoring works best if your profit margins are reasonably high. For larger companies, profit margins of 10% to 15% work well. For smaller companies, a margin of 15% or more works best.

5) Your invoices must be free of liens or encumbrances

You can only finance invoices that have not been pledged as collateral to other institutions, such as banks. Keep in mind that it’s common for many financing institutions to file an “all assets” lien when providing any type of funding. These liens encumber your invoices.

If your accounts receivable is pledged as collateral, the other finance company needs to agree to subordination before the invoices can be factored.

Tax liens or legal judgments (judgment liens) can also encumber accounts receivable. Such liens need to be resolved before your invoices can be funded (see the next section).

6) If you have tax problems or a tax lien, you must have a payment plan

Factoring companies can finance invoices that are encumbered by a tax lien (usually an IRS lien) under certain circumstances:

- You must have a payment plan

and - The taxing authority must be willing to subordinate its position on the receivables

Alternatively, your company can just pay the liability, which removes the lien.

7) You should not have an open bankruptcy

Although it is possible to provide factoring to companies undergoing a chapter 11 bankruptcy, it’s complex and often expensive. However, factoring can be effective for debtor-in-possession financing in some circumstances.

Some factoring companies avoid financing companies whose owners have an open personal bankruptcy.

8) Your personal background must show you have good character

One of the most important requirements to qualify for any type of financing, whether factoring or something else, is to show that you have good character. Factoring companies determine character by checking the background of all applicants to look for criminal records and similar issues.

One last point:

Note that each factoring company is different and has its own specific requirements. However, this guide should give you a good idea of what you need to have in place to qualify for an invoice factoring line. If you are looking for factoring, here are some useful application tips.

Invoice Factoring PROS and CONS

Invoice factoring is becoming very popular all over the world on account of various services offered by the institutions that engage in it. It has indeed become a useful tool for the management of account receivables being employed by small business owners for the release of funds tied up in credit extended to customers.

Invoice factoring also helps to solve problems related to collection, delays, and defaults of the account receivables. Not regarding, the financing technique has its pros and cons, and here’s a brief break down indicating them:

PROS

Small business owners that choose to adopt invoice factoring for their businesses are benefited in a number of ways, some of which are:

- Factors tend to provide specialized services to the business owners with regard to their sales ledger administration and credit control, thus relieving clients from the thoughts of the method of debt collection to adopt. Now, the business owner can focus his attention on the major areas of his business and improve its cash flow as well.

- The advance payments made by the factor to the small business owner with respect to the bills purchased tends to increase his liquid resources and maintain a steady cash flow management system.

- Invoice factoring helps business owners improve on their credit standing with suppliers, bankers, and other forms of lenders, by helping them meet up with their liabilities whenever they arise.

- The factor’s assumption of credit risk relieves business owners from the tension of bad debt losses.

- Invoice factoring gives room for flexibility, helping business owners extend better terms to their customers.

- This financial strategy helps small business owners meet up with seasonal demands for cash whenever it is required.

- Invoice factoring gives room for better purchase planning.

- It saves a business management department the time and effort used in collecting account receivables, and sales ledger management.

- Invoice factoring is an off-balance sheet financial system that does not affect the financial structure of a business. This makes it possible for small business owners to boost their efficiency ratios such as return on assets and many more.

CONS

Below are some downsides of employing invoice factoring in your business:

- Invoice factoring for small businesses may lead to over-confidence in the behavior of clients.

- Small businesses with lesser turnover, highly concentrated businesses with a few debtors, and companies that sell a large number of products of various types to clients or other companies with a lot of debtors for small amounts may not be suitable for invoice factoring.

- A client is liable for invoice factoring only if he or she is creditworthy. This is the most common problem among small businesses when trying to factor receivables.

- There is the problem of fraudulent acts among clients, whereby, a client decides to make more than one invoice in respect of a single transaction. That is, duplicate-invoicing and invoicing on nonexistent goods.

I hope you found this new invoice factoring for business owners’ introductory guide helpful.

Now I’d like to hear from you:

Do you find invoice factoring as a suitable financial option for maintaining a steady cash flow management system?

What type of invoice factoring from the list given above do you think best fits your business type?

And what financial challenges have you faced in the past when using invoice factoring?

Either way, let me know by leaving a comment below right now, and I’d be happy to get back to you.

Wow! I really gained a lot from this post. So I can actually get my customers to pay for my goods and services on a credit term basis and still get my business cash flow management system going. This is great.

Thanks a lot for sharing. Also, can you suggest better ways in which I can manage the cash flow of my business startup? I’m kinda having a challenge doing that.

Thanks a lot

Ok sure… I actually have a post here on Small Business Cash Flow Management Techniques for 2020. Feel free to check it out, and let me know if it helps.