Small business cash flow management is necessary for all types of businesses.

In today’s guide, you will learn everything you need to know about small business cash flow management and how to start implementing it in your business today.

Including:

- Understanding your business working capital

- Solving small business cash flow problems,

- Cash flow management techniques for small businesses,

- And many more…

So if you’re looking for the best techniques to manage your business cash flow, you’ll love this guide.

Let’s get started.

Cash Flow Management: a Way to Control Cash Inflow and Outflow

Cash flow management, in general, is the process of monitoring, analyzing and optimizing business cash flow (net amount). Cash flow, which is a financial concept that shows how cash enters and leaves a business within a certain accounting period, is a major factor that influences business growth!

It is the difference between the cash available at the end of a business accounting period and that at the beginning of the period.

Business cash flow is basically of two types:

- Cash inflow

- And cash outflow

Just as the name goes, cash inflow is simply the cash that enters a business at a certain period, and cash outflow is the cash that leaves a business at that same period.

In small business cash flow management, cash inflow and cash outflow go hand in hand… and timing is everything!

That is, for this system to function effectively, there must be a balance between cash inflow and cash outflow problems.

Cash inflow could be as a result of the following:

- Sales of assets,

- Investments,

- Loan proceeds,

- Revenue acquisition,

- Sales of products or services, etc

While cash outflow could be as a result of the following:

- Purchase of assets

- Payment of staffs, employees, and suppliers,

- Operating and direct expenses,

- Principal debt service and many more…

An effective small business cash flow management system tends to solve the problem of lag between the time in which cash enters the business (cash inflow) and the time in which cash leaves the business (cash outflow).

I repeat: Timing is everything when it comes to small business cash flow management!

With all these said, we can classify small business cash flow problems into two:

- Cash inflow problems

- And cash outflow problems

Cash inflow problems relate to the time delay in driving sales, conversions, collecting payment from customers, and many more… While cash outflow problems relate to the time delay in the payment of suppliers, purchase of good working materials, and even payment of employees.

Cash flow problems arise mainly when business owners choose to use up all their business working capital, thus resulting in little or no cash at hand to invest back in the business.

Cash flow is the movement of funds in and out of a business, and if not managed properly could lead businesses to go bankrupt. Share on XHere’s exactly how business cash flow management works:

When starting a new business, cash is usually spent on new equipment and other expenditures. This type of cash is referred to as a cash outlay.

A good small business cash flow management system helps to delay cash outlays for as long as possible until the necessary steps are taken to encourage customers to pay for products and services.

Cash Flow Problems

Brands and businesses usually face cash flow problems due to the following reasons:

- Lack of proper planning

- And the lack of education and experience

Every business has its common pitfalls when it comes to managing cash flow process, but most often find themselves in a cash crunch. This could be because they are not well knowledgable of the business they are diving into;

Or didn’t take out time to carefully plan how cash would be coming in and out of the business!

Cash flow problems arise mainly during cash inflow or outflow processes.

Cash In-flow Problems

The two most common cash inflow problems include:

- Ineffective system of management of business

- Poor methods of collection

Cash Inflow Problem #1: Poor Business Working Capital Management

The need for working capital in a small business organization cannot be overemphasized!

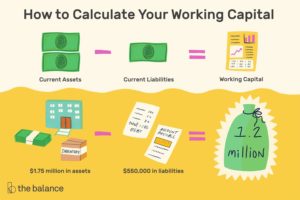

Working capital is the overall difference between an organization’s current assets and liabilities which helps them carry out important day-to-day financial operations.

The management of current assets is particularly important in the case of small and medium-sized companies (SME’s) because:

Unlike long term assets, current assets are the assets which a business can convert into cash within an accounting year.

Working capital is basically of two types:

#1: Positive working capital, and

#2: Negative working capital…

A business working capital is said to be positive when it has more current assets than current liabilities. This means that the business is capable of covering all its short-term liabilities as they come due in the next 12 months.

Positive working capital is a sign of financial strength, but could also mean otherwise. Share on XNow, some may be wondering: How does excess working capital influence cash flow problems for small businesses?

Well, when a small business has an excessive amount of working capital for a long period, it could mean that the company is not managing its assets effectively, and this has a very poor business cash flow management strategy.

A business is said to have a negative working capital if its current liabilities exceed the current assets. Negative working capital is not necessarily bad news for businesses!

In fact:

The fact that your business is having a negative working capital could be as a result of a large cash outlay due to the purchase of a large number of products and services from vendors.

Negative working capital is not so harmful to business, especially when it lasts just for a short period of time. But once it extends further, it may be a major cause of concern.

This is because:

When negative working capital is left to extend further in time, it simply indicates that such a business is still struggling to make ends meet, which may lead to borrowing or taking up stock issuances in order to finance the working capital.

There are no specific rules or formulae set aside to help small business owners determine their working capital requirements. And this could lead to them getting more than they need for their business or even worst, getting less than they require!

Here are some factors that generally influence the working capital requirements of businesses:

1) Nature of Business

Working capital requirements of a business are influenced by the nature and size of the business.

For instance, businesses basically in the service industry require a low level of working capital than businesses in the manufacturing sector.

This is because they don’t necessarily have to pay cash for inventory!

Businesses in the manufacturing sector, on the other hand, require a higher level of working capital because it takes a longer time to produce and market their goods and products.

So it’s important for you to determine the nature of your business, to get an understanding of how much working capital that works best for you.

2) Operating Cycle:

A business operating cycle is the time it takes for that business to create and sell a product or service… Businesses that have a longer operating cycle require more working capital to ensure that financial obligations incurred in the interim can be met.

It is for this reason that small business owners are advised not to give out goods and services to customers on a credit basis!

Doing this tends to prolong the business’s operating cycle, thus leading to the request for a higher working capital just in case collection on accounts receivable cannot be made on time.

The credit terms to be granted to customers should strictly depend on the norm of your business.

Yes, businesses have the flexibility of shaping their credit policy, but this should be done within the constant of their norms and practices.

Being able to figure out your business operating cycle is crucial in determining how much working capital you need for your business to perform at its best.

3) Management Goals

Your business goals also determine its working capital.

Rephrasing this, we can say: It’s a must for small business owners to first figure out their working capital needs before venturing out into other business activities.

For example, a business owner may require a $100,000 in working capital for his business, while to another business owner, this amount may be considered too much. It all depends on their business goals.

Most business owners might think taking more working capital than their business really needs is the best choice for them, but this shouldn’t be so.

If at some point you realize that your business requires additional working capital, it’s not so bad to apply for a small business loan, a business line of credit or a credit card.

With that said, here are some disadvantages of excess and insufficient business working capital:

Disadvantages of Excess Working Capital

As discussed earlier, an excess of business working capital over a long period could mean that the business is not managing its assets effectively, and in turn, has a very poor business cash flow management strategy.

- Excess business capital could make it difficult for a company to monitor its cash inflow: Since funds are in excess, the company would find it difficult to know if they are making profits or losses. Customers could be taking goods and services on credit and if left unattended, could lead to the company having so many bad debts.

- It gives rise to speculative transactions: As the name goes, speculative transactions are transactions that involve some speculative risks… That is, the eventual net return or final cost of the company’s sales and purchases is not known in advance.

- An excess of a business working capital could lead to the purchase of unnecessary inventories in bulk: Why won’t it be when the cash is also there in bulk. Yes, businesses are sometimes advised to buy inventories in bulk to save costs and get products at a lower price, but too much working capital could make a business owner go ahead to buy goods and services that won’t be valuable to him, even in the long run. So one can also say that excess business working capital could make a small business owner make unwise decisions.

- It creates room for idle funds: These funds may not even be used to earn profits for the business. This leads to a decrease in the rate of return on investments

- Drives investors and shareholders away from your business: When shareholders and investors see that your business is getting a lower rate in return on investments, they’d want to pull out and invest in a better firm. And as more investors leave your business, your business will experience a decline in its value of shares.

Disadvantages of Insufficient Working Capital

Just as excess working capital is bad for business, insufficient working capital also has its disadvantages… Some of which include:

- It cripples business activities: The business will find it difficult to pay for its day to day activities and try out new business opportunities.

- Delay in the payment of short term liabilities: Insufficient working capital just means that a business will find it difficult to pay for its short-term liabilities on time. This could ruin the business reputation, making it difficult to get good credit facilities such as small business loans.

- Difficulty in exploiting favorable market conditions: This includes the ability to purchase goods in bulks and being credible to get discounts on goods and services purchased.

- A decrease in the rate of return on business investments: As discussed earlier, this could also drive away investors and shareholders.

So, how much working capital does your business really need?

This is not the right question you should be asking. Instead, first, try to understand the following:

- How quickly do your customers pay for your goods and services? (number of days)

- How quickly are you required to replace inventories?

- How quickly do you need to pay your suppliers and product vendors?

As you can see, timing is crucial in determining your business working capital… There’s the need to satisfy both customers and product vendors on a timely basis!

These components can also be used to determine your business turnover ratios!

Determining your business turnover ratios is also essential in the process of determining its working capital. Turnover ratios help business owners predict:

- The average number of days it takes to receive payments from clients,

- The average time which inventories sit on shelves,

- And the period it takes the business owners to pay creditors, product vendors, and suppliers.

So you see, an effective system of management of business working capital is essential to keep your business cash flow management in check.

Cash Inflow Problem #2: Poor Methods of Collection

A business’s method of collections is the various ways which they use to receive payments from clients and other business partners. A poor method of collection can cripple your business activities and generally disrupt its cash flow management.

Poor methods of collection could lead to the following:

- Bad debt expense

- Inconsistent invoicing

- Out-of-sync credit terms

- Insufficient gross margins

- Overestimating future sales volumes

I mean this in every possible way: bad debt expense is bad business!

This disrupts your business cash flow management system.

It’s true that at some point customers could be credit-worthy, but when these debts are being prolonged and left unpaid for, that’s when it becomes really bad for your business!

What’s the worst?

These bad debt expenses can lead business owners to go into bad debt themselves… How?

Well, it’s quite simple!

When a small business runs at so many bad debt expenses, and there’s no proper way of documenting it, the business owner could result in requests for more funding to finance his working operation.

The problem sometimes isn’t from the customers but the business owner himself!

Yes!

Many businesses lack the standard process to collect these unpaid bills from customers. The truth is: sometimes customers are slow in paying because business owners fail to remind them when the money is due.

Sometimes that little push is all that is needed to collect on outstanding funds.

Here are the best ways to solve the problem of bad debt expense and improve your business cash flow management system:

#1: Avoid the Use of Payment Terms

Most payment terms give customers the freedom of slacking when making payment on a purchase.

Payment terms will allow the customer 30, 60 days or even more to pay rather than acquiring the products or services and paying on delivery.

So, unless you trust a customer implicitly, it is always best to make the payment right away for a purchase.

#2: Invoice Factoring

Cash flow problems are best to be avoided, but even if your business is experiencing a cash-flow crisis, there are several things you can do to get back on track. By implementing some basic processes to ensure timely invoices, collecting on unpaid bills and maintaining clear-eyed projections about your company’s future revenue and expenses, you can keep the cash flowing — and the company growing — for years to come.

Invoice factoring is one of the best ways of getting an advance on outstanding invoices. It can also be regarded as Accounts Receivable Financing. Learn more…

#3: Offer Discounts on Cash Payments

Instead of offering payment terms to customers, offer them a discount whenever they pay cash for a purchase. You can, however, offer customers who normally would take advantage of your 30-day payment option (terms) a discount if they pay cash immediately.

Cash Outflow Problems

Cash outflow problems include:

- High overhead cost

- Unnecessary purchases during the startup phase

- Failed marketing campaigns

- Paying bills too early

Cash Outflow Problem #1: High Overhead Cost

Most small business owners actually spend more than expected in running their business which in turn affects their small business cash flow management system.

Overhead costs are expenses spent in running a business that’s not tied directly to selling a specific product or service.

Overhead expenses include telephone utilities, employee salaries, rent, office equipment, and supplies, external legal and audit fees, etc.

High overhead costs can hurt your small business cash flow management system. Share on XEmploying five workers to carry out a certain function in your business that just three employees can handle will lead to you spending more on employee salaries, which in turn affects your business cash flow management system negatively.

The solution to high overhead expenses is quite simple, but not so easy to implement.

You can start by leasing equipment instead of buying them, especially those that won’t be needed by your business in the nearest future. Equipment like computers, vehicles and many others can also be leased when necessary.

Expenses should be audited to know where to cut back and keep overhead expenses in line. But be very careful not to cut back too much as this could also hurt your business.

Also, as a small business owner, you have to check to see if you are paying yourself or employees too high and cut back on it.

Cash Outflow Problem #2: Unnecessary Purchases During Startup Phase

There’s a popular business quote that says:

It takes money to make money!

This is actually true for all types of businesses; unfortunately, this common belief can make a small business owner fall prey to gross overspending and making unnecessary purchases — especially in the first few months of starting the business.

If you really want your business to succeed, you have to keep your eyes on the bottom line… And before making any purchase, consider the cost-benefit of that purchase, keeping in mind that every dollar you spend is one that’s ultimately taken away from your profit margin.

For every of your business revenue forecasts, create a realistic budget and stick to it!

Also, try as much as possible as not to overestimate your business future sales volumes as this could lead you to buy more than what your business can really take-on at that point in time.

Whenever an unexpected expense or opportunity for impulse spending comes up, go back to your projections and calculate the effect of such purchase to your break-even point.

Cash Outflow Problem #3: Failed Marketing Campaigns

This is one major cash flow problem every business should strive to tackle.

Failed marketing campaigns could result from cash outflow problem #2 listed above.

When a business has a large number of goods stocked over a long period of time, it may result in drastic marketing campaigns to sell them off. This could cause them to skip out certain key metrics, leading to a failed marketing campaign, and as well crippling its small business cash flow management system.

Cash Outflow Problem #4: Paying Bills too Early

This appears to go against all that we have been told, however, it truly doesn’t.

All bills should be paid on schedule, when due!

Small Business Cash Flow Management Techniques for 2020

The following can be adopted to maintain a solid cash flow management system:

#1: Short and Long-Term Financing

Most small business owners get really scared to apply for a business loan because they feel that it’d get them more in debt than they normally are.

But the truth’s that you don’t really have a choice…

If your business lacks the required working capital needed to operate, your business will fail!

Despite your best efforts to maintain a steady cash flow for your business, there may be times when you’d need to make a large purchase, encounter an unexpected expense or your business simply didn’t bring in as much revenue as anticipated.

Having a business line of credit in place can be really helpful in times like these to bridge the gap.

Depending on your business needs, institutions such as banks, shareholders, online lending companies are always willing to provide you with short and long-term financing to keep your business going.

#2: Offer Multiple Modes of Payment

Constraining your clients to only one method of payment regardless of whether it’s cash, check or credit card only goes to encourage them to make slow payments or no payments at all.

There’s no denying that technology has made it quite easy for businesses to collect on payments–from making orders online, to even paying for a friend when going out for dinner.

However, most small business owners still offer payments by paper check even though it takes longer and costs more. This is mainly due to a false sense of security and how digital online payments work.

But the truth’s that these alternative methods of collecting payments have been known to bring more income for businesses known to adopt them.

In fact: Businesses that offer ePayments have been known to get paid 2x faster than cash, and nearly 3x faster than a check.

ePayment methods include any of the following: PayPal, Payoneer, Apple Pay, Bitcoin, Venmo, etc…

#3: Forecast Cash Flows for the Short Term to Account for Seasonal Changes

When forecasting your cash flow, create a rolling 12-month spreadsheet plan and commit to updating it at the end of each month. This will give you a complete picture of your business’s financial health, making it really easy to anticipate cash shortages and taking advantage of higher revenue periods even in the event of unforeseen seasonal changes.

By knowing how much money is coming in and out of your business monthly, you’d be in a better position to maintain control over its cash flow.

#4: Automation Gives a Bird’s-Eye Perspective on Business Cash Flow

According to Paramount Workplace: 62% of businesses still make use of paper processed invoices, while 92% still use checks as a medium of payment, both to pay invoices and on the receiving end. Since all this requires manual data entries, it can get extremely difficult to track cash flow through an accounts receivable to an accounts payable.

Here are some strategies you can adopt for automating your small business cash flow:

- Adopt cloud-based accounting solutions that meet specific requirements of AR, AP, and cash flow management, and don’t get weighed down with unnecessary features.

- Stick with accounting and financial software with high-end predictive analytics features that accurately predict business cash flow, based on your business’s previous expense history.

Now, What Do You Think?

Now I’d like to turn things over to you, the business owner:

What small business cash flow management mistakes have you been making that has crippled your business growth?

Are there any cash flow management techniques you’ve been trying for your business for a while that doesn’t seem to be working?

Or maybe there’s actually a cash flow technique from this blog post that caught your attention, but you’re confused about how to apply it to your business growth…

Either way, let me know by leaving a comment below now!

General FAQ

Small business cash flow management is the process of monitoring, analyzing and optimizing your business cash flow (net amount).

For any business cash flow management system to function effectively, it must be able to balance its cash inflow and cash outflow problems.

Business cash flow is the movement of funds in and out of a business at a certain accounting period.

Business cash flow can be either cash inflow or cash outflow.

When starting a new business, cash is usually spent on new equipment and other expenditures. This type of cash is referred to as cash outlays.

A good small business cash flow management scheme helps to delay cash outlays for as long as possible until the necessary steps are taken to encourage customers to pay for products and services.

Just as the name goes, cash inflow is simply the cash that enters a business at a certain period, and cash outflow is the cash that leaves a business at that same period.

A business working capital is an overall difference between its current assets and liabilities which helps it carry out important day-to-day financial operations.

[…] The advance payments made by the factor to the small business owner with respect to the bills purchased tends to increase his liquid resources and maintain a steady cash flow management system. […]