Today I’m going to show you where to find the best financial sources for small business funding in 2020.

This post contains 10 trusted financial sources you can use to get funding for your small business or startup… in less than a month!

Let’s dive right in.

#1: Bootstrapping a Business

This is the process of launching and building a business or company from scratch, with little capital and no funding from external sources. Rather, the business is being funded by personal savings, credit cards, and cash coming in from daily sales.

There are countless examples of big companies today that started off by bootstrapping – Dell computers and Coca Cola.

A recent example is GoPro Inc which started out as an effort to capture high-quality surfing action on film. Today, it’s a multi-billion company that makes and markets sports cameras.

Typically in bootstrapping, a business startup can only fund itself from what it makes. It requires the business owner to shape his mindset in a way to attain the growth of his or her business.

The various methods of bootstrapping a business include:

1) Personal Savings

From one’s personal savings, it’s totally possible to fund a growing business. This strategy requires strategic budgeting and planning.

2) Credit Card Debt

What if you borrow some money from your credit card, invest it in your business, get profit, refund back your credit card debt and still have enough left to fund your business growth?

Jeremy Cash, the young CEO has this to say:

This method of small business funding works best for digital marketers.

For example, you could be selling a digital product that pays out $50 in commission. You could decide to use your credit card debt to run a paid advertisement for your digital product – let’s say you spend up to $40 running the paid ads daily, and you convert with 3 to 4 sales for the day (that’s like $160).

After paying back your credit card debt, you’ll still be left with $120 for the day to invest back into your business. And with paid advertisement, you could get more than 4 sales with that $40 for the day.

So you see, the possibilities of funding a business using credit card debt are endless.

3) Selling (Pre-Selling) Products & Services

By selling products and services in your business, you can get more money to fund its growth. And if you have a proven audience demand, you may be able to get customers to pre-order your products or service to supplement the money needed to deliver on the orders.

But when pre-selling, you must be very careful to avoid running at a loss. You must make sure you have well-calculated the true costs to deliver on the products or services as promised, or you’ll begin to lose the trust of customers which could put you out of business before you ever begin.

4) Gifts (Loans) from Family and Friends

This is one of the oldest financial sources for small business funding.

Yes, bootstrapping also involves getting support from family and friends. Here are 3 successful entrepreneurs of today that took loans from their friends and family to finance their business growth:

The best part of using bootstrapping for business is that you as the business owner maintains full control of your business, with no payment terms nor requirement.

There’s also the freedom to test different markets and how successful your business idea would be before taking on other kinds of financial sources.

#2: Small Business Grants

Grants are given to eligible businesses, especially SMEs in their startup phase for the purpose of expansion, research, and development. These grants are given by either the government, private or corporate companies, etc.

>>More: The #1 Small Business Grants Guide for 2020

Unlike small business loans or credit cards, these grants are essentially free money given to small business owners and do not require any form of repayment.

#3: Angel Investors

An angel investor is an individual who seeks to invest in the early stage of a business startup. They commonly invest in businesses that are involved in manufacturing, medical technology, software development, and telecommunications.

Yes, it’s true that angels help to build entrepreneurs, but it’s also important to note that entrepreneurs help to create angel investors too.

Did you know: 55% of angel investors were previously founders or CEOs of a startup? Share on XAnd angel investors with an entrepreneurial background tend to write larger checks, with an average investment of about $39,000 as compared to $28,000 for those with no entrepreneurial background.

>> More: Everything you need to know about angel investors.

Angel investors are always looking to invest in businesses that can reach up to $50 million within three to seven years after funding.

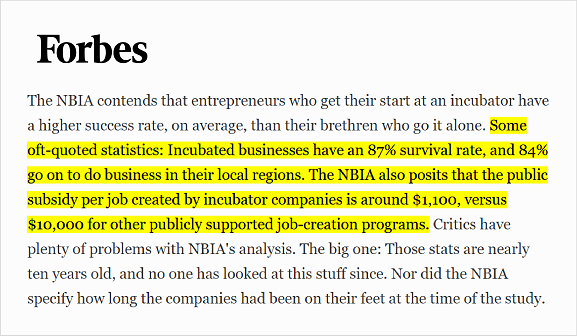

#4: Business Incubators

This is one major financial source that helps small businesses and startups to quickly enter the market, allowing them to immediately get down to business without all the hassles of setting up an office.

The term incubator was a common term used in the TV series – Silicon Valley, where Erlich Bachman(a software designer) housed a bunch of tech nerds at his own home which he called the incubator. Erlich later went on to have a stake in Richard Hendricks’ company (one of the tech nerds) when it became successful.

Another really good example of what a business incubator is can be seen here:

Still, business incubators vary in their different strategies.

Some incubators take the form of a virtual space meant to foster networking among young entrepreneurs, startups, and their coaches. Others may operate on a virtual platform.

A good example of a fully virtual business incubator is the One Million by One Million initiative.

The best part?

Business incubating is all about teamwork. That is, you don’t really need to have a multi-million dollar company to have your own incubator.

You could get some friends and colleagues who have the same business initiative with you, get them on your team, agree on some terms, and by combining resources, just watch your business grow.

But it’s always good to work with professional business incubators. You can find one with the help of the International Business Innovation Association (InBIA).

The SBA could also come in handy here!

The InBIA has more than 1,400 members in the United States and a total of 1,900 members in 60 nations Share on XIncubators as one of the best financial sources for small business funding helps them in saving funds on rent, equipment purchase, and also give them access to services such as accountants and lawyers – not to mention personal coaching and networking connections through the staff and other entrepreneurs at the incubator.

#5: Crowdfunding

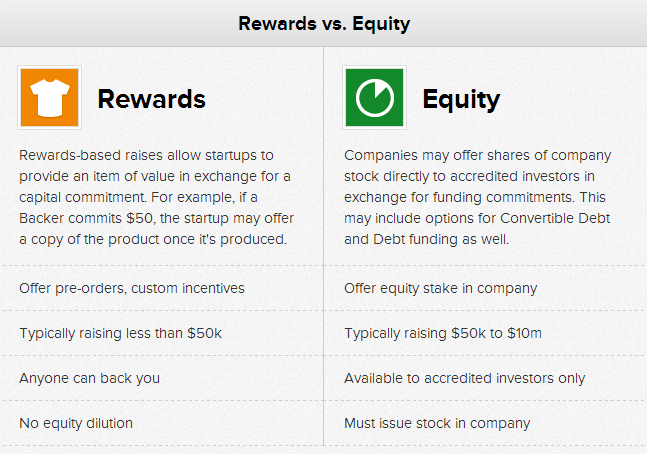

Crowdfunding is one of the financial sources for small business funding whereby capital is being raised with the collective effort of a large number of people who each contribute a relatively small amount, typically through social media platforms or other crowdfunding platforms.

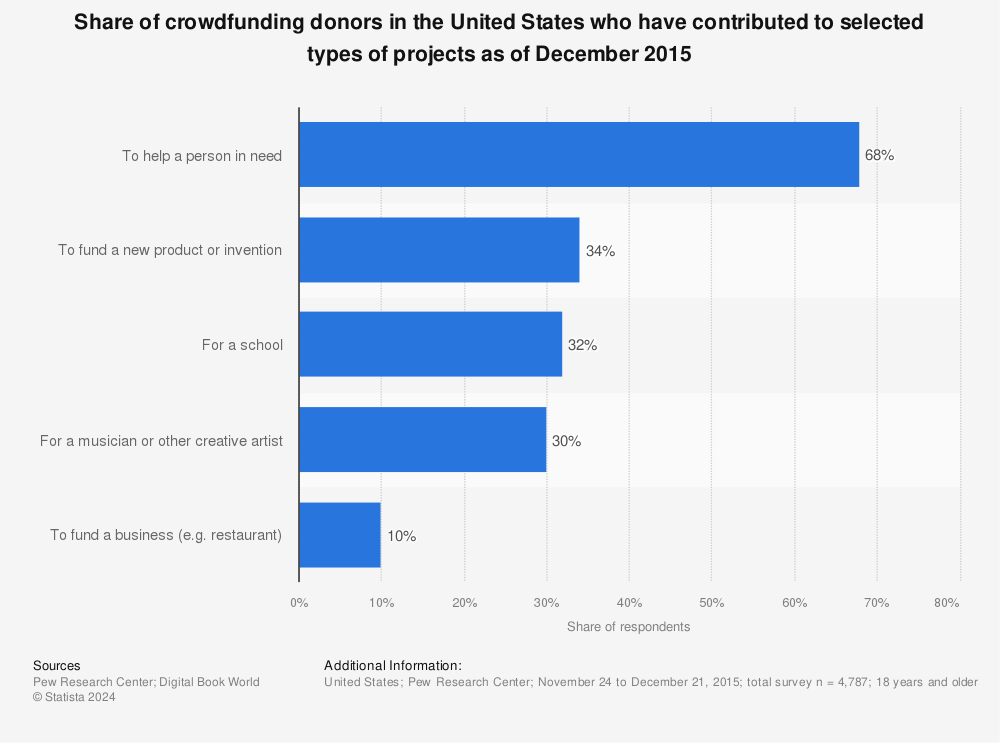

Crowding works best when you’re trying to raise capital to launch a new product for your business. According to the stats below:

- Donation-based crowdfunding

- Rewards-based crowdfunding

- Equity-based crowdfunding

Donation-based crowdfunding is any typical crowdfunding campaign in which there’s no financial return to the investors or contributors. This is not really a common means of getting small business funding as investors usually want to get something in return from the business for their investment.

Crowdfunding as a financial source for small business funding also gives small business owners the reach they need to get them in touch with accredited investors who can see, interact with, and also share their fundraising campaign.

You should note that crowdfunders tend to invest in businesses that communicate better to them. So a good quality video and sales script will help you communicate with them.

#6: Venture Capitalists

For small business owners that are in search of larger funds beyond what an angel investor can offer, then you can try out venture capitalists.

VCs act as a gateway for small businesses and companies on the potential brink of success, but they can be one of the most difficult to track.

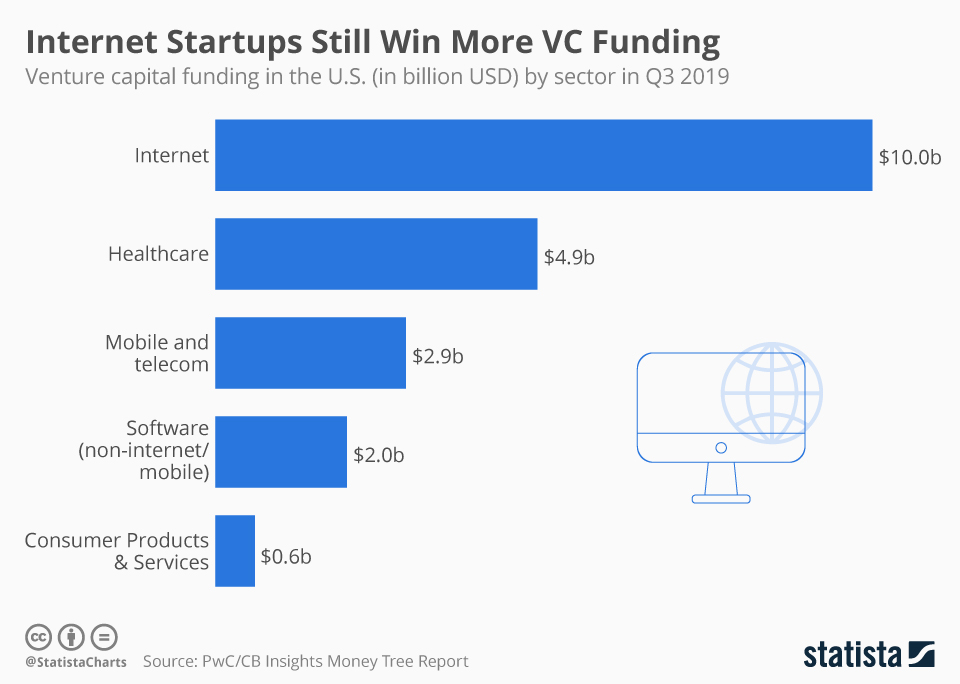

But businesses that have most of its activities done on the internet tend to have the highest wins when it comes to getting funding from venture capitalists.

Some well-known venture capitalists include:

- Peter Theil – Facebook’s first investor, and the co-founder of PayPal,

- Jeremy Levine – and the largest investor in Pinterest,

- Chris Sacca – an early investor in Twitter and Uber

- Jim Breyer – an early Facebook investor,

- Peter Fenton – an investor in Twitter.

#7: Invoice Factoring

Every business owner has come to a point where they found it difficult to collect on payments from clients and customers, and this can slow down a business’s cash flow.

Invoice factoring is an alternative financial source for small business funding that helps to keep the cash coming into the business even when there are a lot of unpaid debts.

>>More: Invoice factoring made easy.

#8: Small Business Loans

Small business loans should be approached strategically.

Most small business owners do not understand the various types of small business loans and how to apply them to aid their business growth. Asides the regular traditional bank loans and loans from online lenders, we still have:

- Asset-based loans

- Business line of credit

- Business acquisition loans

- Merchant cash advance

- Equipment loans

- Working capital loans

These loans are meant to solve specific cash flow issues in a company, and none should be mistaken for the other.

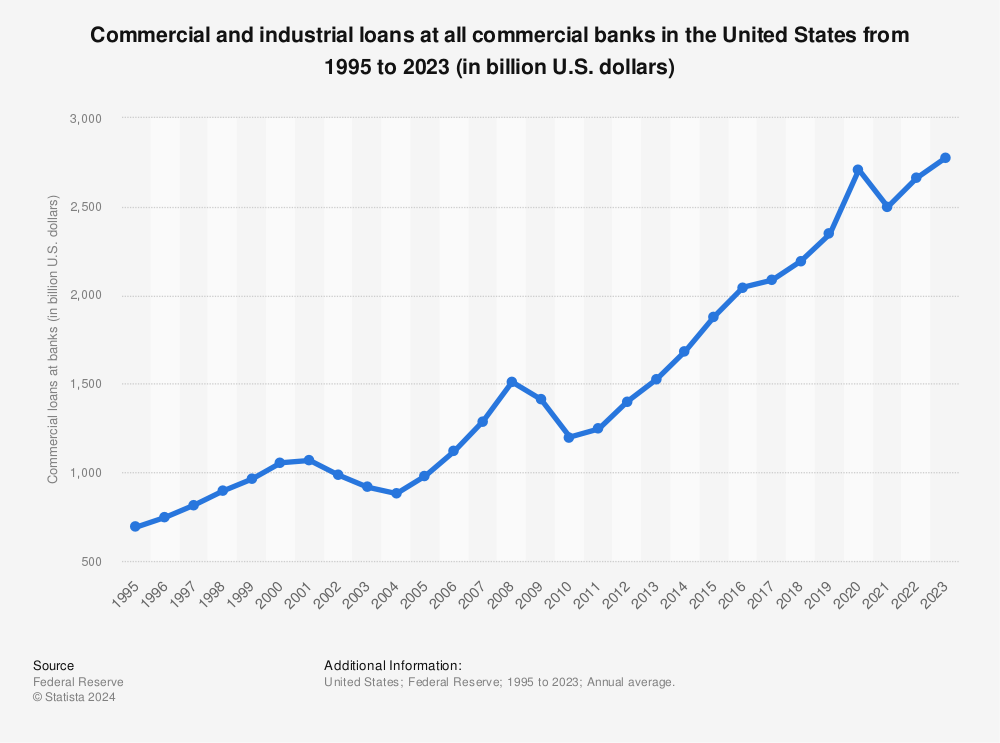

Traditional bank loans remain a default option for many small businesses and startups.

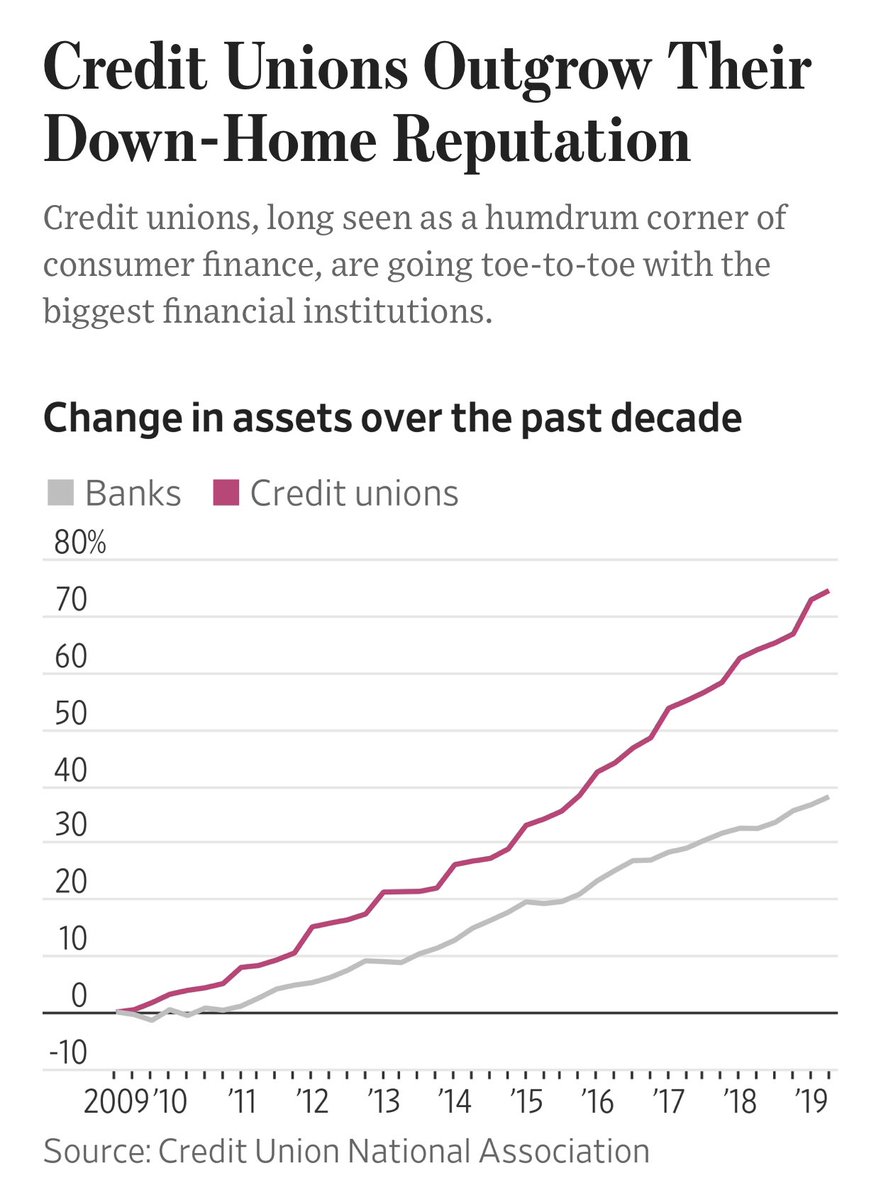

#9: Credit Unions

Although credit unions are quite similar to commercial banks, you should note that they are generally smaller in size and are limited in the amount of money they can provide in the form of loans to its members.

This is why credit unions are one of the best financial sources for small business funding because they don’t small businesses and startups don’t really require substantial funds to get started.

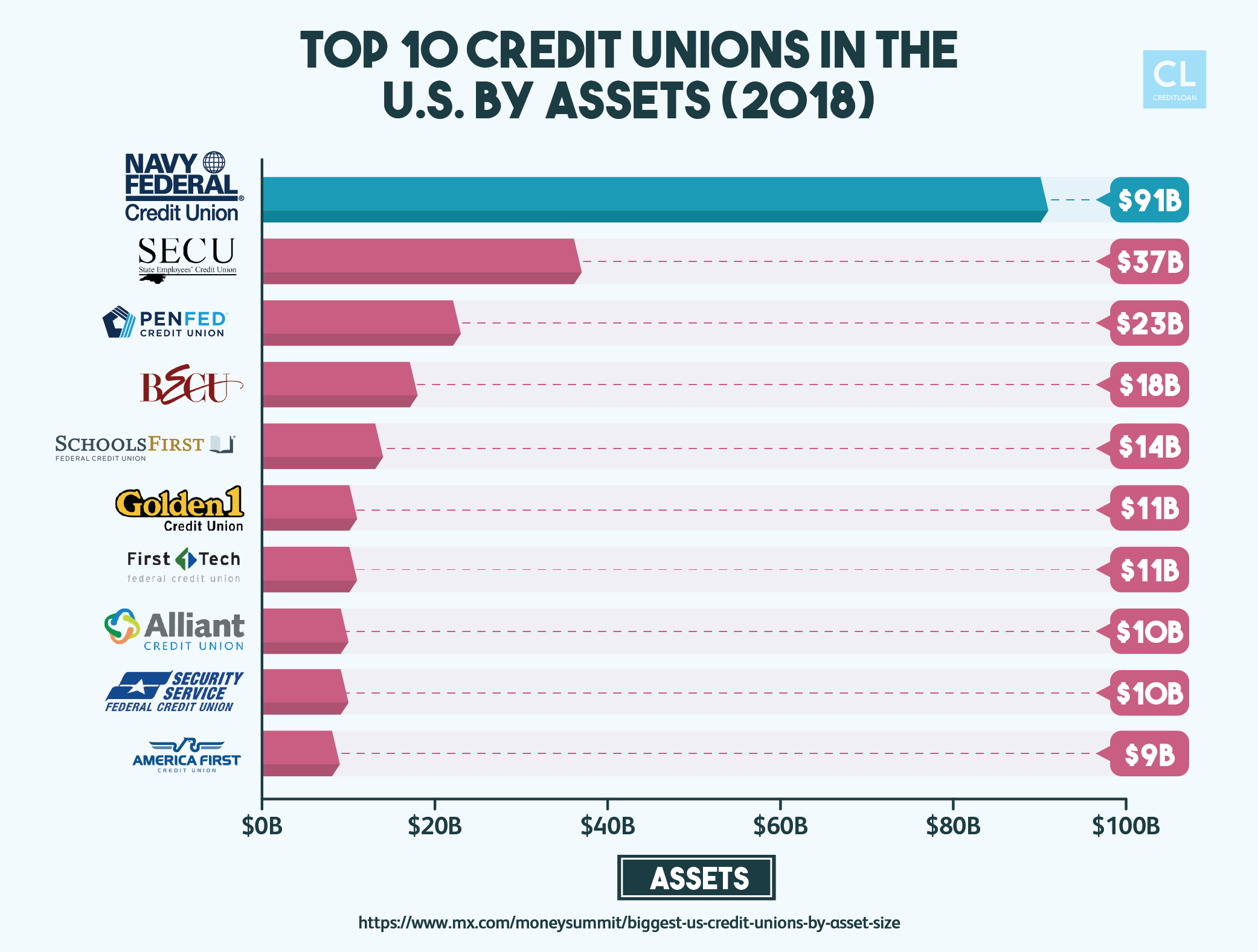

Here you see that more people are leaning towards credit unions for funding than regular commercial banks. The below illustration shows the top 10 credit unions in the United States based on assets:

Credit unions are non-profit enterprises that enjoy tax-exempt status. They are created, owned, and operated by their various participants.

The system follows a basic business model in which each member pools their money – technically buying shares into the cooperative. This would, later on, help them to be able to provide loans to any member in need of one, request for deposit accounts, and other financial products or services from each other.

#10: Government Subsidies

Ever since the Great Recession, the United States government has always been willing to assist small businesses in any way possible.

One of those many ways is by helping to subsidize business sectors, especially those that are really vital to the economy. Some of these business sectors include:

- The agricultural sector

- The energy sector

- The transportation sector

These are the three biggest beneficiaries that receive billions of dollars annually and subsidy plans from the government.

The agricultural sector, for example, is subsidized through cash payments and non-repayable loans. The USDA also gives out insurance at affordable rates to farmers against the risk of inclement weather and pests.

Conclusion

When it comes to financing your business, you can choose to try out one of the above-listed small business financial sources.

But note, only go for a source of funding that suits your business type; and do not apply for external funding when you know that you do not need one.

Keep in mind that an excessive amount of working capital for a long period could just mean that your company is not managing its assets effectively, and this could pass a bad message to investors.

Now I’d Love to Hear from You:

- Which of the financial sources for small business funding are you going to try out first? And why?

- Or maybe you’ve had difficulties in the past in getting one of these types of small business funding.

Either way, I’d love to hear from you. So do not hesitate to leave a comment below.

Wow!

I never really got to know about business incubators up until now. I mean I used to hear a lot about it from the TV series, Silicon Valley, which you rightly mentioned… But I thought it was all fallacy.

Also, nice talks on the bootstrapping. Really learned a lot today.

Thanks for sharing!

Me too… lol! I guess most things in the movies are actually real, and we could also learn some business growth strategies from them too

I really learned a lot from this post.

But can you please shed more light on the credit card part??? Like on what the YouTube kid talked about funding your business using credit card debt, can I get more clarity on that?

Thanks

I think Venture Capitalists are the best source of funding, especially for startups in 2020.