Article Map

Every good business entrepreneur deserves to know what is the best bank for small business checking accounts. These type of bank accounts will give you the ability to manage your daily small business finances.

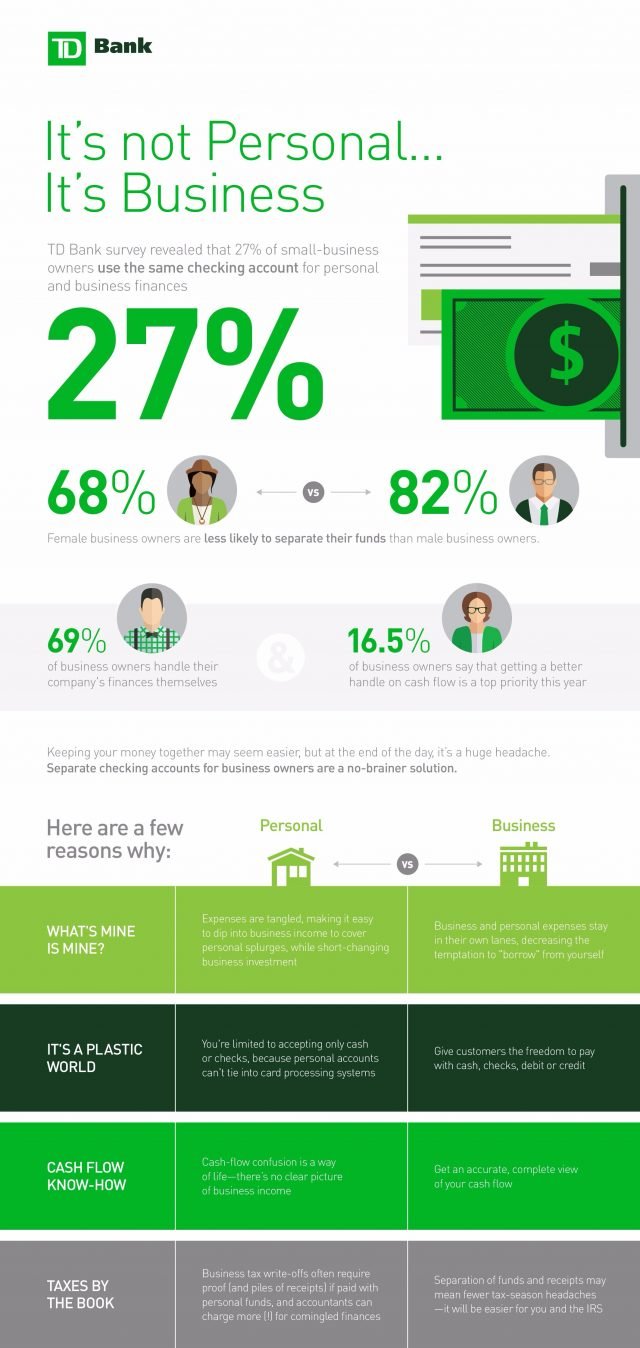

With the daily deposits, bills settlement and budgeting that goes on in a small business setting, it’s quite easy for any business owner to confuse between his or her small business and personal expenses.

In fact, according to Small Business Trends, a rough 27% of small business entrepreneurs use similar banks they use for their personal finances for their business.

Small business checking accounts will help you to easily distinguish between both expenses, whilst helping you to prepare for your taxes and legitimately dominate your small business’s financial presence.

But still, you can’t do all these without knowing first – what is the best bank for small business checking accounts in 2021.

What is the Best Bank for Small Business Checking?

Having to choose between the best banks for small business checking accounts is one decision that every small business owner must make at some point in time.

Must Read: 7 Things Nobody Tells You About Running a Business...

There are so many metrics to use in determining what is the best bank for small business checking accounts for entrepreneurs, but which are actually the best to choose from?

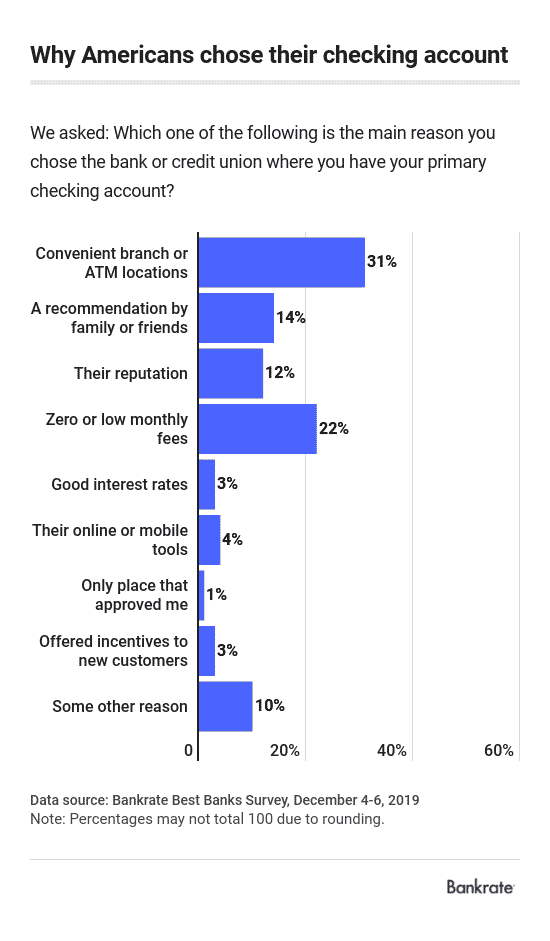

It is one thing to open a small business checking account with a bank, and it’s another to actually main such account with that bank. And according to a survey conducted by Bank Rate, the following are reasons why most Americans chose their checking account bank:

- Convenient brand and easy access to ATM

- Recommendation from friends or family

- Reputation

- Low monthly fees

- Good interest rates

- Mobile friendliness

- Last option for approval

- Incentives for new customers

- Others

The stats are further broken down in the illustration below:

Pointing out from the above illustration, you can see that some of the major factors to know what is the best bank for small business checking accounts include: a closer proximity to the bank and good ATM network, reputation and trust, low monthly fees, as well as good interest rates.

Thus, the bank you choose for your small business can be more important than you think to its success. This choice impacts how much you pay every much in banking fees, whether you qualify for a small business loan down the line, and how easy or difficult it is to manage your business sales transactions.

So with nearly 6,000 banks in this United States, what is the best bank for small business checking accounts?

That being said, LoanGrip was able to put together a comprehensive list to help you in determining what is the best bank for small business checking accounts today:

- Brick & mortar vs digital

- Fees & interests

- Minimum balance & deposit requirement

- APY

- Small business loan offerings

- Tools and support

- Ease & convenience

#1: Brick & Mortar vs Digital

Small business owners have different preferences and needs. For example, if you run a fast-food restaurant, you’d probably receive thousands of dollars in cash monthly that you’d need to deposit to your bank.

But, in contrast, if you run a digital solutions business, you might need to collect payment from customers and pay other service companies that you work with using a more cashless means like through bank transfers, credit card payment and lots more.

Though, a rough population of small business owners still find it so difficult to trust digital banks, these differences in business types will definitely impact the bank you ultimately choose for your small business checking account. Thus, the battle between brick & mortar banks and digital banks coming into play.

A restaurant owner, retailer or other types of business owners that process a lot of cash and maintains a cash-register will be better off choosing a brick-and-mortar bank with physical branches.

On the otherhand, a B2B sell, IT firm or ecommerce store will do just fine with a digital online bank for their checking accounts.

Digital banks can also be good for cash-based businesses as they also allow for mobile check deposits and electronic transfers; They also offer much lower fees than the usual brick-and-mortar physical bank.

But, where digital banks won’t be a good choice is for you is you wish to write a check or deposit cash in your daily business transactions.

#2: Fees & Interests

This is one of the major factors for knowing what is the best bank for small business checking accounts. It takes up about 22% of the reasons why Americans choose their checking accounts.

Banks charge fees for all kinds of things, so it’s important that you read the fine print for any accounts before you sign up.

On small business checking accounts, banks often include only a certain dollar-amount of cash deposits and a certain number of transactions each month for free, after-which they charge fees.

An average of $7.69 is usually charged in fees monthly on small business checking accounts – this includes ATM and overdraft fees, and also routine service charges. Some other fees that you’d be charged on your small business checking account include:

- Lost debit card fees

- Paper statement fees

- Cheque fees

- Foreign transaction fees

- Wire-transfer fees

- Inactivity fees

- Account closing fees

Most banks will also charge you a monthly service fee if you do not maintain a certain balance in your account.

Community banks usually charge lower fees than large national banks.

In determining what is the best bank for small business checking accounts, it’s best to go for a bank that offers the least monthly fees.

On the flip-side to fees, you should find out if you’d be earning interests on savings on your checking accounts. Though interests on savings accounts tend to be low, you can earn more interests on money-market accounts and certificate on deposit, if your bank provides those.

All these are major factors to consider in determining what is the best bank for small business checking accounts.

#3: Minimum Balance & Deposit Requirement

As discussed earlier, most banks will require you to maintain a minimum balance on your checking account. Some banks will also require that you have a minimum deposit when opening your checking account.

All these are very important factors in determining what is the best bank for small business checking accounts.

Thus, to avoid paying fees that come with violating these terms, its best to examine your business needs and go for a bank that proffers the right kind of checking account option that best suits your small business type.

It’s also good to go for a bank that will enable you earn on APY (Annual Percentage Yield).

#4: APY

As the name goes, APY (Annual Percentage Yield) is the total amount of interest you could earn all through by compounding over a period of one year.

Your APY is a major factor in determining the best bank for small business checking accounts – not all banks will pay you on annual interests!

So ensure that you go for a bank that actually offers this for your small business checking account. This can serve as additional cash to improve your small business cash flow.

#5: Small Business Loan Offerings

As a small business owner, you’d definitely seek for other sources for your small business funding, and a small business loan is one of those.

Small business loan offering is definitely a major factor in determining what is the best bank for small business checking accounts.

Some banks specialize in offering SBA (Small Business Administration) loans that usually attract the least interest rates and are the longest term loans that you can get for your small business.

Though small business checking accounts are mainly used for deposits and withdrawals, you can actually use them to secure a small business loan. Thus, you can use your checking account to get the following kind of loans for your business:

- Equipment loans

- Commercial real estate loans

- Lines of credit

- Credit cards

- And more…

Just ensure to have a good enough credit score when applying.

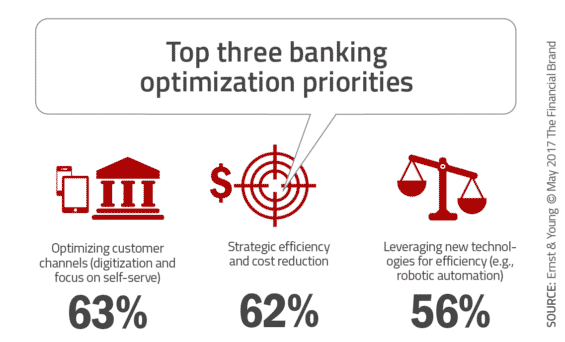

#6: Tools & Support

Your bank checking account must offer your business the best possible options for growth. So ensure to prioritize this when determining what is the best bank for small business checking accounts.

Although you may find this very surprising, many banks actually offer value added non-banking services for small businesses. Non-banking services include: credit card offerings, merchant services accounts, point of sale solutions, integrated payroll and budgeting tools.

Budgeting tools in particular can be very helpful, especially if you have multiple accounts at the same bank. Utilizing the bank’s budgeting tools will give you a general overview of all your accounts, categorized transactions, and save money towards specific business goals.

And for credit cards, many banks offer cashbacks or rewards, but these bonuses vary a lot from banks to banks. Some banks offer cashback for all small business purchases, while others focus on business-specific categories such as shipping supplies.

Having one bank that offers all these services for your checking account will save you a lot of money, not having to hire someone to get the job done for you. You also get the convenience of having multiple tools accessible through the same bank.

#7: Ease & Convenience

Asides from the regular brick-and-mortar vs digital bank feud, one of the best and most convenient way to bank is online.

So in determining what is the best bank for small business checking accounts you must consider ease and convenience.

That being said, most banks today have developed mobile apps where users can come and interact with, and perform daily bank transactions directly on their mobile phone.

As much as possible, go for banks that offer checking account options that can be accessed easily online. These usually attracts the least fees as discussed earlier.

Conclusion

In determining what is the best bank for small business checking accounts, it’s also good that both you and your bank understands your business industry and goals.

Does your bank suggest products and services that seem like a good fit for your company?

It’s also important to check to see how responsive the bank is by email or phone since you won’t always time to visit the bank in person.

Now I’d Love to Hear from You:

- In determining what is the best bank for small business checking accounts, would you rather work with a brick-and-mortar bank or an online-based bank? And why?

- What other factors are also essential in determining what is the best bank for small business checking accounts?

Let us know by leaving a comment below!