This is an introductory guide to small business grants in 2020.

In this new guide, you’ll learn exactly how to get small business grants for your businesses in 2020, including:

- Small business grants for startups;

- Small business grants for women;

- Small business grants for minorities

- Small business grants for veterans

- Lots more

Let’s get started.

What is a Small Business Grant?

A small business grant is a form of financial assistance given to a business by an organization for a specific purpose.

Grants are given to eligible businesses, especially SMEs in their startup phase, or for a company’s expansion, research, and development. These grants are given by the government, private or corporate businesses, etc.

Unlike small business loans or credit card debts, grants are essentially free money given to small business owners and do not require any form of repayment.

The best part?

They have no effect whatsoever on your business credit score!

Basic Types of Small Business Grants

There are basically two types of small business grants:

- Government grants

- Private & Corporate grants

#1: Government Grants

When learning how to get business grants from the government (both federal and state), you can go through various government databases based on your current location and business type.

The major disadvantage of searching for a government business grant is that you may have to pay some money to be able to access government databases, and still, the entire system is poorly organized and outdated.

Another disadvantage of government grants is that they do not cover the cost of starting up a new business or its operational expenses, rather, they are more focused on funding research and development, technology, and conservation.

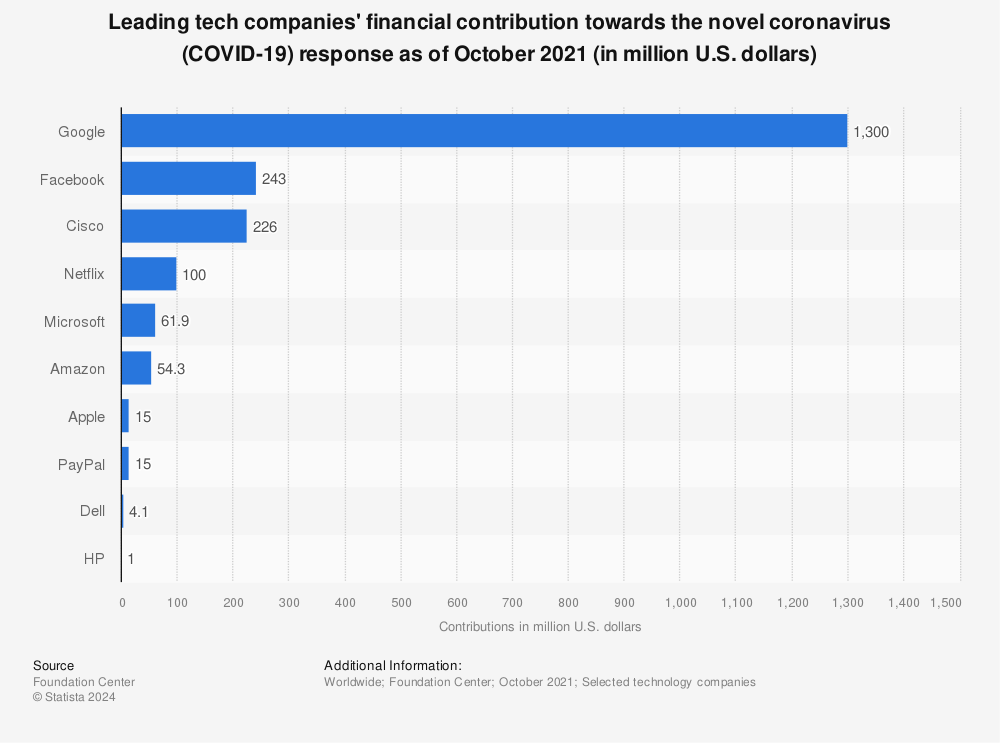

Find more statistics at Statista

Find more statistics at StatistaGovernment grants can be subdivided into:

- Federal grants

- State grants

Below is a complete list of where to get federal business grants for small businesses in 2020:

1) Grants.gov

This is the official site to get access to federal government administered grants.

You can start your search here for small business grant opportunities, and also check your business’s eligibility stats in the eligibility box.

2) GrantWatch

This is an online platform where you can find funding through federal, state, local, foundation, etc grants both in the United States and Canada.

They also provide an option for you to filter between business grants.

The only downside to using this platform is that you are required to pay for a membership on the site to view your eligibility stats for a grant.

3) Challenge.gov

They provide a list of creative, technical, and scientific competitions and prizes provided by the federal government in order to drive innovation in the country.

4) SBIR.gov

SBIR is short for Small Business Innovation Research Program.

This is a really competitive small business grant program that encourages small business owners across the United States to participate in research and development for federal agencies.

>>MORE: SBIR small business grant requirements

The program is overseen by the United States Small Business Administration for high-tech innovation.

The STTR (Small Business Technology Transfer) program is yet another competitive grant program that provides funding opportunities to encourage innovation, research, and development.

But the STTR program requires applicants to collaborate with a non-profit research institution during the first two program phases.

The qualification requirement for this grant program is that you must currently be running a for-profit business with less than 500 employees.

A good alternative to government business grants are grants from the state government. Federal grants for small businesses are limited by industry and in number, but state grants have a wider variety of lesser-known opportunities for small business owners.

Below is a complete list of where to get access to state grants for small businesses in 2020:

1) EDA.gov

The Economic Development Administration (EDA) is a United States’ Department of Commerce agency that offers grants, resources, and technical assistance to small business entrepreneurs and innovators.

2) The State Business Incentives Database

This is a national database for business development finance professionals, economic developers, and researchers.

The State Business Incentives Database was created by the Council for Community and Economic Research (C2ER) to provide data on incentive programs from all states and territories in the United States.

3) Americas SBDC

SBDC stands for Small Business Development Centers, and they provide support for small business owners and aspiring entrepreneurs across the U.S.; they also assist existing businesses to remain competitive in a very competitive market.

The SBDC also helps to connect small business owners with financing, networking opportunities and mentoring.

4) USDA Grants

The United States Department of Agriculture (USDA) offers a variety of grants for small business owners and nonprofit organizations operating specifically in rural areas.

#2: Private & Corporate Grants

Private and corporate grants are much preferred especially for young entrepreneurs with great business ideas and looking for startup funding.

Below is a complete list of private and corporate bodies that offer small business grants in 2020:

1) Facebook

The popular social media network is currently offering $100M in cash grants and ad credits to small businesses that were affected by the coronavirus.

Find more statistics at Statista

Find more statistics at StatistaFacebook that has already contributed a lot towards controlling the current pandemic is also coming up with alternatives to assist small business owners to keep their workforce going strong.

2) NASE Growth Grants

By becoming a member of the National Association of the Self-Employed (NASE), you will get opportunities to apply for their business grants.

They offer business grants up to $4,000 per month, which could cover some of your business’s monthly routine expenses.

3) Patagonia Corporate Grants

Patagonia offers small business grants that range from $10,000 to $20,000 to support small, grassroots activist organizations that work strategically to preserve and protect the environment, local habitats, and frontline communities.

4) Nav’s Small Business Grants

Nav often offers quarterly small business grants of up to $10,000 in a contest for the best small business owner and business’s personality.

Private bodies like FedEx and VISA often host small business grant contests too yearly, but it’s quite unfortunate that the contest for 2020 has ended.

Demographic-based Small Business Grants

- Business grants for women

- Business grants for veterans

- Business grants for minorities

These kinds of business grants are funded by corporations, special interest groups, the SBA, and even the government.

#1: Small Business Grants for Women

These grants are available for women business entrepreneurs only. Small business grants for women can be found amongst some of the above-listed options, but one specific way that women entrepreneurs can get funding in the form of grants for their business is with the SBA (Small Business Administration).

Did you know: Women have a 69.5% success rate of crowdfunding for their businesses while men have a 61.4% success rate? Share on XThe SBA supports women entrepreneurs is through its support of a national center of women’s business centers. This program offers both businesses mentoring and networking opportunities for women entrepreneurs, training, business plan development, and access to funding.

You can use the SBA’s lookup tool to get access to an SBA-supported Women’s Business Center (WBC) near you.

The SBA also has its InnovateHER challenge, an annual competition where they award grants to three national finalists in the range of $40,000, $20,000, and $10,000 respectively.

This competition is part of the SBA-supported WBC.

Below is a list of where to find small business grants currently available for women in 2020:

- Amber grants for women

- Backstage Capital

- Black Girl Ventures

- Female Founders Fund

- Intel Capital Diversity Initiative

- PeaChic

- Toptal

#2: Small Business Grants for Minorities

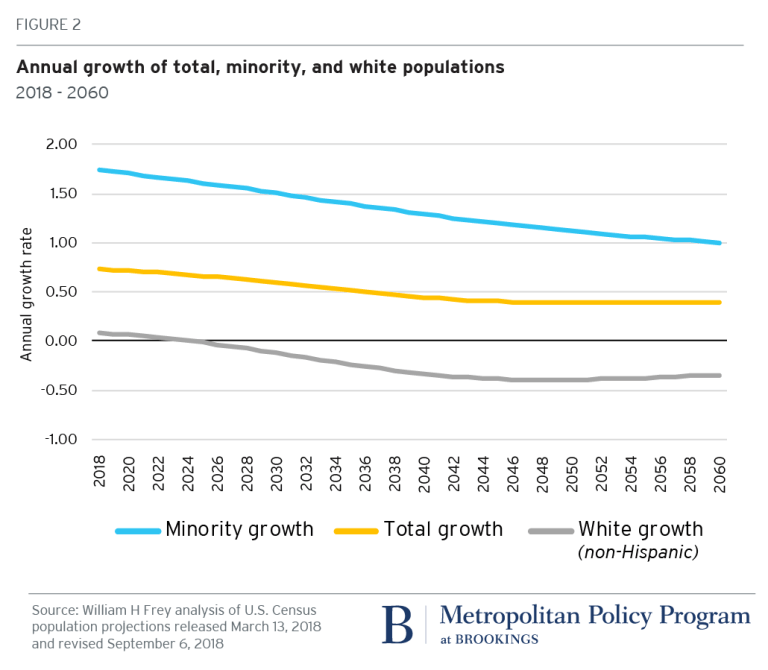

From 2014 to 2016, the overall number of minority-owned employer businesses in the United States rose by 11%, while the non-minority figures rose only by 1%. This may be due to the increased annual growth of the minority population in the country.

And out of all racial and ethnic groups, Blacks or African American owned employer firms had the greatest share of female owners, at about 39%.

American Indian and Alaska Native employer firms had the highest share of veteran-owners across all racial and ethnic groups, at about 13%. Native Hawaiian and other Pacific Islander businesses had the youngest owners, as 12% of them had their owners under the age of 35.

This is one of the reasons see it worth investing in minority-owned small businesses. Below is a list of where to find small business grant opportunities for minorities in 2020:

- Minority Business Development Agency

- Minority Business Enterprise

- Operation Hope

- FirstNations

- Rural Business Development Grants

- Tribal Energy Development Capacity Grant Program

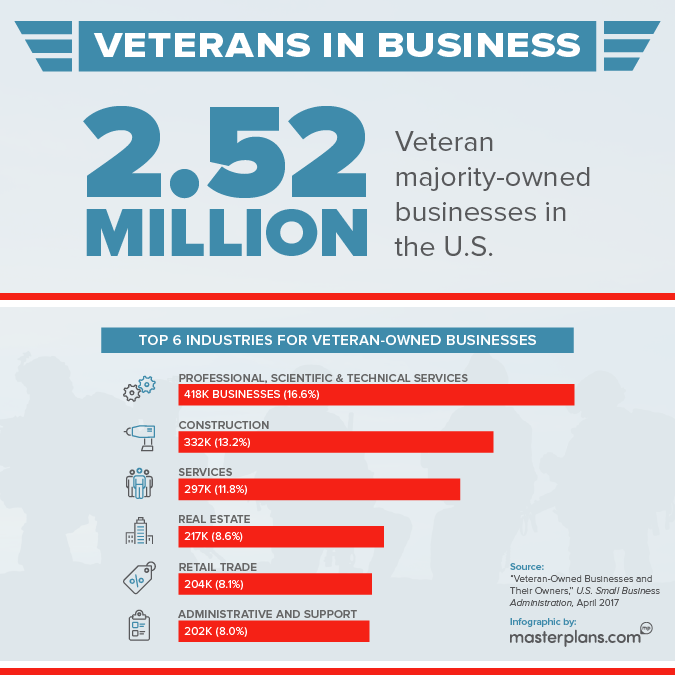

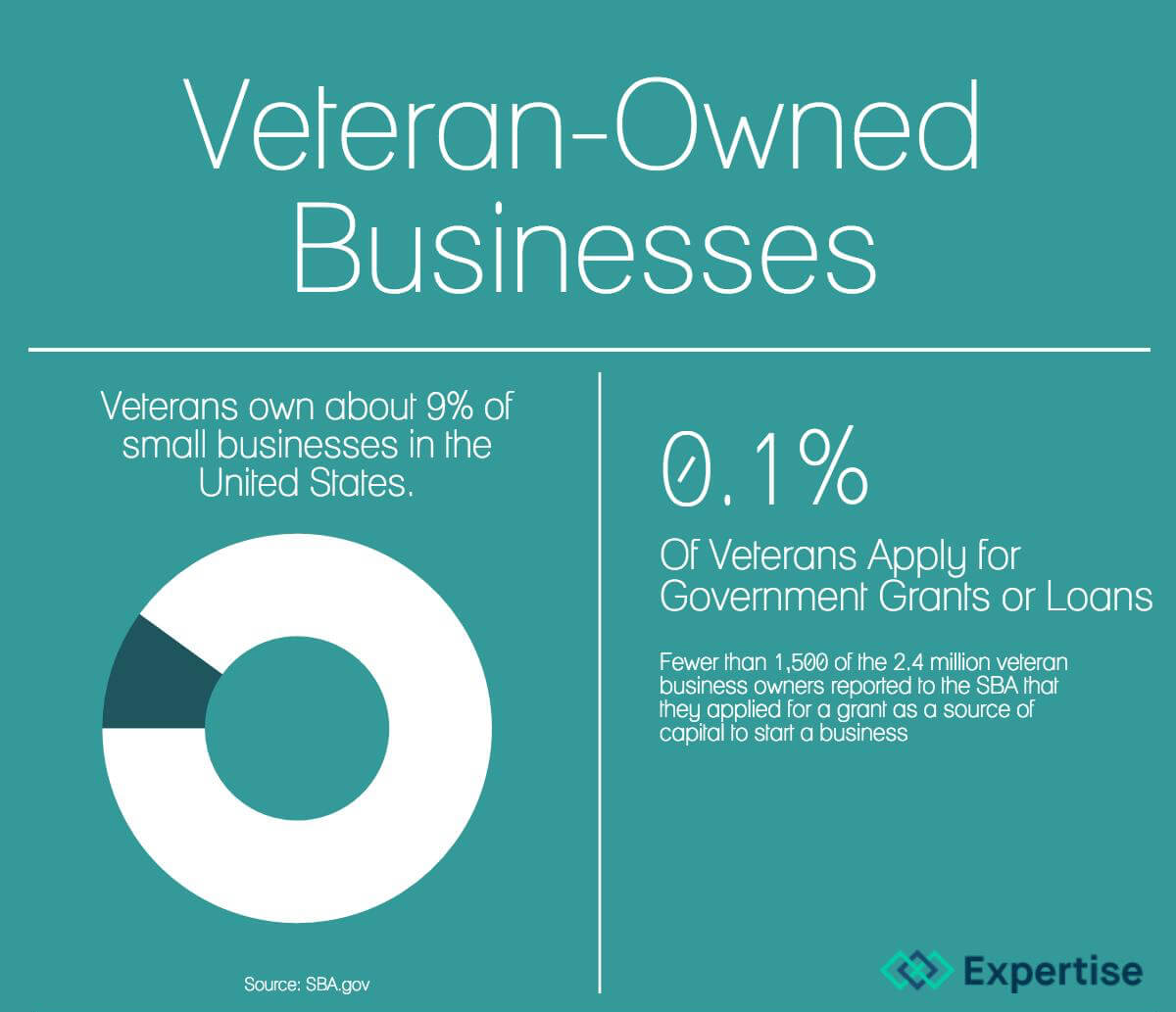

#3: Small Business Grants for Veterans

Over 2.5million businesses in the United States are owned by veterans.

PS: A veteran is anyone who has at some point in time served in the Armed Forces (army, navy, air force, coast guard, marine corps) and was discharged with reasons other than dishonorable.

Below is a list of where to find small business grant opportunities for veterans in 2020:

How to Apply for Small Business Grants in 2020

The first step to learning how to apply for a small business grant is actually finding a good business grant that suits your business demographics. Luckily, we’ve been able to discuss the various small business grant types and requirements in the options listed above.

But still, the bulk of small business grant opportunities comes from the private sector.

Big companies like FedEx and VISA often provides a hefty sum too to small businesses for entering a contest or pitch competition, and even though you don’t win, there’s the possibility to get a price or publicity for your business as a runner-up.

These private business grants usually come with a less rigorous application requirement but are a bit more competitive to get.

Now, here’s exactly how to apply for a small business grant in 2020:

- Pay close attention to the listed requirements of the grant before applying. Noting that some business grants come with restrictions – for example, a business grant offer may be directed towards non-profit organizations only, so you, as a for-profit organization applying for the grant may just get your request denied. And sometimes, you may be required to spend the grant money in a particular way, maybe to fund equipment purchase, or for the payment of employees alone, as outlined by the grant provider. Don’t try to fudge the truth still, because not playing by these rules could result in some penalties.

- Provide accurate and complete information on the required details needed for the grant application. Incomplete grant applications have been known not to make it through the screening process.

- When preparing your application, stick strictly to the provider’s requirements – that is, if a section asks for a maximum of one page, don’t write one that is lesser or more.

- Follow up with the grant officer. You can add him or her up on their various social media handles (most preferably their professional handles like LinkedIn) and get a sense of what they’re really looking for. The more you know, the better your chances of getting the business grant.

- Have a well-crafted business plan. Your business plan should properly describe the future of your business and what factors you have listed out that will make your business successful. It’s also important to list out some of your business weaknesses and how the grant offer would help in dealing with it.

- Finally, a good follow up is needed to seal the deal. After submitting your small business grant application, it’s okay to keep in touch with your grant officer in a non-intrusive way with respect to how the application process is going.

Conclusion

I really hope you enjoyed this guide. You can find more alternative financial sources for small business funding right here. We also have listed, the best ways to get lenders to forgive loans in 2020.

Now I’d love to hear from you:

- Which of the above listed small business grants do you plan on trying out first?

- Do you find small business loans easier to get than a business grant?

- Or maybe you have a question about something listed out in today’s guide.

Either way, let me know by leaving a comment below!